To see your take‑home after tax, Australian pay calculator.

Capital Gains Tax (CGT) Calculator Australia

This capital gains tax calculator helps you estimate the Australian tax on profits from selling assets. Ideal for property, shares, and crypto, this tool simplifies the capital gains tax calculation for the 2025-26 tax year.

Step 1 of 3: Asset Details

Asset Details

Your Situation

Results

How Capital Gains Tax Calculation Works

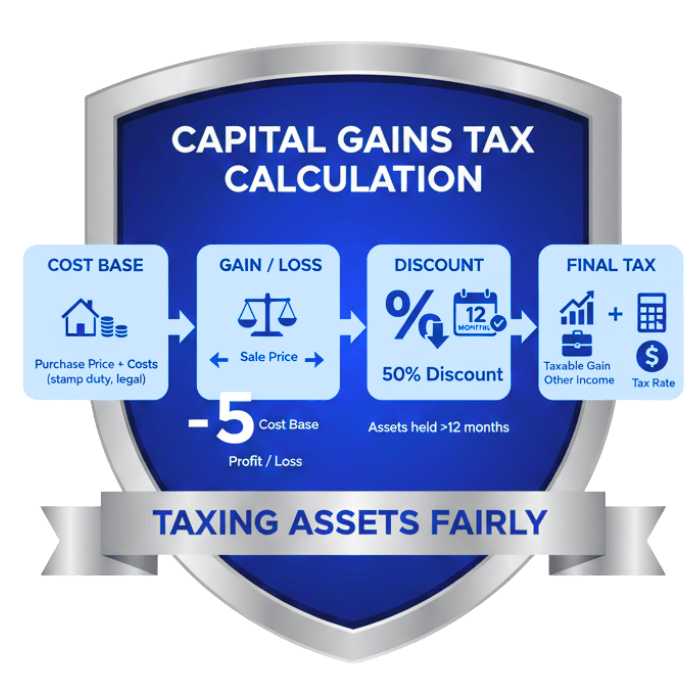

How Your CGT is Calculated in Australia

- Calculate the Cost Base:This is the initial purchase price plus all associated buying and selling costs (like stamp duty and legal fees).

- Determine Capital Gain or Loss:Subtract the total cost base from the final sale price.

- Apply Losses and Discounts:First, subtract any available capital losses. Then, if you've held the asset for over 12 months, apply the 50% CGT discount to the remaining amount.

- Calculate Final Tax:The resulting amount is your 'taxable capital gain'. This is added to your income for the year and taxed at your personal marginal tax rate.