Australia Superannuation Calculator & Estimator (2025-26)

Use our super calculator to project your retirement balance. See how salary sacrificing and different investment returns can impact your superannuation fund in Australia. For a detailed salary breakdown, visit our pay calculator homepage.

Your Super Fund Details

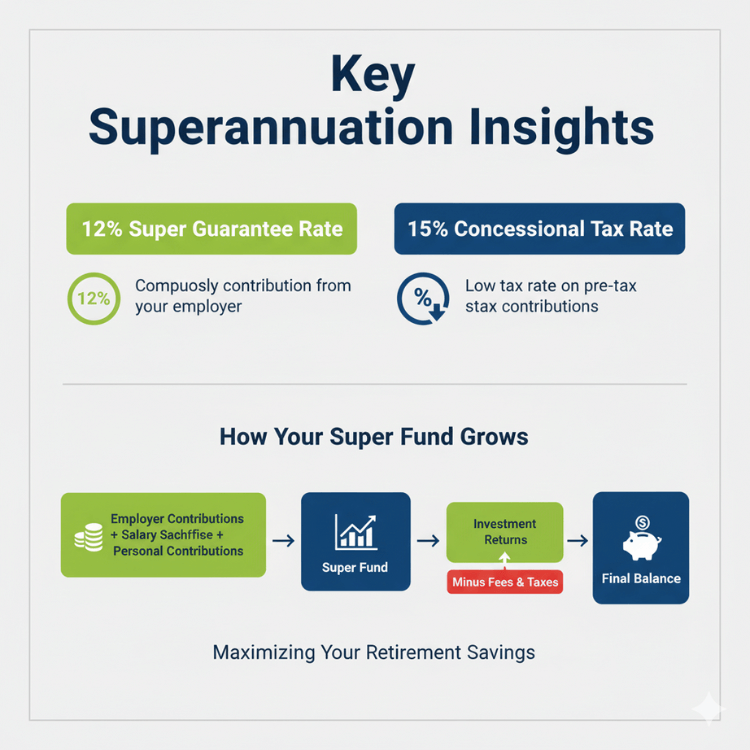

Key Superannuation Insights

Understanding the core components of the Australian super system is key to maximizing your retirement savings.

12%

Super Guarantee Rate

The compulsory contribution from your employer.

15%

Concessional Tax Rate

The low tax rate applied to pre-tax contributions.

How Your Super Fund Grows

Your superannuation grows through a combination of contributions and investment returns. Understanding this flow is vital.

Superannuation in Australia: FAQs

Common questions about using a super calculator and how superannuation funds work in Australia.