To see your take‑home after tax, salary calculator Australia.

Company and Sole Trader Tax Calculator Australia

Compare the tax outcomes of operating as a sole trader versus a company. This tool estimates the income tax for your business, showing whether the flat company tax rate or personal sole trader tax rates are more effective for your bottom line.

Business & Salary Details

Enter your estimated annual profit and the salary you would draw as a director to see the tax for each company structure.

Overall Financial Position

Which structure leaves you with a better net position (cash in hand + business net assets)? This compares the sole trader tax rate against company taxation.

-$625

Sole Trader Advantage

If this is positive

$625

Company Advantage

If this is positive

Sole Trader

Company

Understanding Business Taxation Structures

The key difference between a sole trader and a company lies in how money flows and how it's taxed, impacting the final income tax for the business.

Sole Trader Tax Rate Flow

As a sole trader, you and the business are the same legal entity. All profit flows directly to you and is taxed at your personal marginal tax rates. There is no special tax rate for a sole trader.

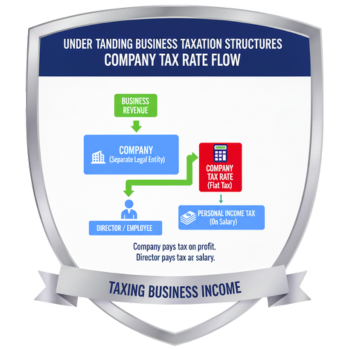

Company Tax Rate Flow

A company is a separate legal entity. It earns the profit and pays tax at the flat company taxation rate. You, as the director, are an employee and are paid a salary, which is then taxed at personal rates.