Child Support & Family Tax Benefit Snapshot

An estimator for child support payments and Family Tax Benefit (FTB) Parts A & B in Australia. Based on the 2025 Basic Formula.

Parental Income

Include income from all sources (jobs, investments, etc.)

Note: A 'self-support' amount of $29,994 is deducted from each parent's income before calculation.

Care Arrangements

Understanding the Child Support & Family Tax Basics

Child support and family benefits can be complex. Here’s a simple breakdown.

What is Child Support?

Child support is a payment made from one parent to another to help with the costs of raising a child after a separation. The amount is based on each parent's income and the amount of time they care for the child. The goal is to ensure children receive a similar level of financial support as they would have if their parents were together.

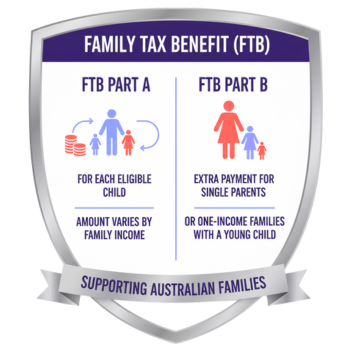

What is Family Tax Benefit (FTB)?

FTB is a payment from the Australian Government to help with the costs of raising children. It comes in two parts:

- FTB Part A: Paid for each eligible child. The amount depends on your family's income.

- FTB Part B: An extra payment for single parents and some families with one main income to help with the costs of a young child.