Fringe Benefits Tax Calculator

A simplified tool to estimate an employer's FBT liability for common benefits. For the FBT year 1 April 2025 - 31 March 2026.

Step 1 of 4: Benefit Type

Benefit Type

Benefit Value

GST Treatment

Results

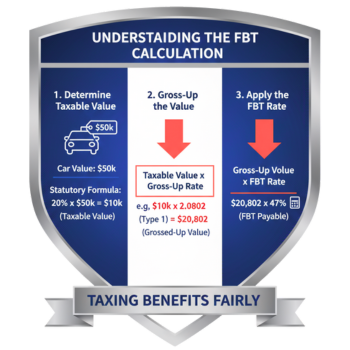

Understanding the FBT Calculation

Fringe Benefits Tax is designed to ensure that the tax paid on benefits is equivalent to the tax that would have been paid on a cash salary. This is achieved through a "gross-up" calculation.

- Determine the Taxable Value: This is the value of the benefit provided to the employee. For cars, this is often calculated using the statutory formula (20% of the car's base value).

- Gross-Up the Value: The taxable value is multiplied by a gross-up rate to reflect the pre-tax salary that would be needed to purchase that benefit. The rate depends on whether GST was paid on the benefit.

- Apply the FBT Rate: The grossed-up value is multiplied by the FBT rate (currently 47%) to determine the tax payable by the employer.