To see your take‑home after tax, Calculate your pay online.

PAYG Withholding Calculator

Estimate the tax an employer should withhold from an employee's pay for the 2025-26 tax year. For a full salary breakdown, use our main pay calculator. If you have large deductions, you may be able to reduce this withholding with a PAYG Variation.

Employee's Pay Details

Enter the gross pay and select the pay period.

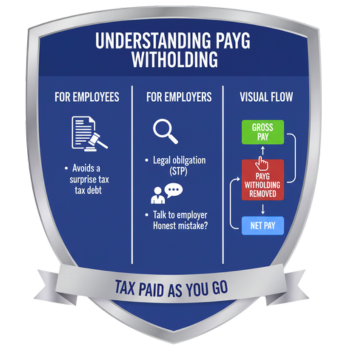

Understanding PAYG Withholding

PAYG Withholding is a crucial part of the Australian tax system. It ensures that income tax is paid gradually throughout the year, rather than as a single large bill after you lodge your tax return.

For Employees

It makes managing tax obligations easier and helps you avoid a surprise tax debt at the end of the year.

For Employers

It is a legal obligation to withhold tax from your employees' pay and report it to the ATO, typically through Single Touch Payroll (STP).