Tax Deduction Calculator

Use this interactive checklist to find common tax deductions and estimate their impact on your tax refund for the 2025-26 tax year.

1. Your Income

Start by entering your estimated taxable income before any deductions.

$

2. Find Your Deductions

Go through the categories and enter the amounts for any expenses you incurred.

Summary

Total Claimable Deductions

$0

Estimated Tax Refund Boost

$0

Based on a 30% marginal tax rate.

Taxable Income (Before):$90,000

Taxable Income (After):$90,000

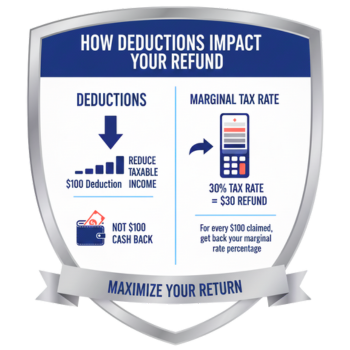

How Deductions Impact Your Refund

Tax deductions don't reduce your tax bill dollar-for-dollar. Instead, they reduce your taxable income. The actual cash benefit you receive depends on your marginal tax rate (the rate of tax you pay on your highest dollar of income).

For every $100 you claim in deductions, a person on a 30% tax rate gets approximately $30 back.